|

|

|

|

|

Consumer Guides |

Government Guides |

Consumer News |

Consumer Guides

Index

Consumer Guides

Home

Submit Government Guide

________

Disclaimer

FAQs: Currency

Buying, Selling & Redeeming

Source: US Treasury Department

How do I purchase sheets of uncut paper currency through the mail?

Does the Treasury Department sell shredded paper currency? Where can I buy it?

I have an old currency note. Can you tell me what it is worth? I would like to sell it.

I have some old silver certificates. How can I trade them in for silver dollars?

I have some old gold certificates and would like to trade them in for gold. What should I do?

Q. I have some currency that was damaged. My bank will not exchange it for undamaged currency. What can I do?

A. You will be interested to know that the Bureau of Engraving and Printing (BEP), through its Office of Currency Standards, processes all

|

|

reimbursement for damaged United States currency. They decide the redemption value of torn or otherwise unfit currency by measuring the portions of the notes submitted. Generally, they reimburse the full face value if clearly more than one-half of the original note remains. Currency fragments measuring less than one-half are not redeemable.

If you feel that the currency you have clearly meets these standards, then you should forward it to the Department of the Treasury, Bureau of Engraving and Printing, Office of Currency Standards (OCS), Room 344-PD, Post Office Box 37048, Washington, D.C. 20013. You can now also visit the OCS on-line to get complete information about handling unfit currency notes. Upon receipt, the OCS will examine the currency to decide its authenticity and suitability for redemption. They will notify you directly of their findings. Unfortunately, it is impossible to predict how long this procedure will take, due to varying workloads. However, they make every effort to speed up shipments when possible.

Q. How do I purchase sheets of uncut paper currency through the mail?

A. The Bureau of Engraving and Printing (BEP) operates a mail order division and has been selling uncut sheets of currency through the mail since October 26, 1981. In addition, the BEP participates in numismatic and philatelic shows located throughout the country where they offer uncut currency for sale. You can now access the Public Sales page and print out an order form to send to the BEP.

Q. Does the Treasury Department sell shredded paper currency? Where can I buy it?

A The Federal Reserve System destroys worn currency notes at some of its various banks located throughout the country. Our Bureau of Engraving and Printing (BEP) only destroys currency during the . This is limited to those notes that are imperfect. The BEP packages small bags of shredded currency from the destroyed new currency. They sell these bags as mementos to visitors at the BEP's Washington, D.C. facility. Unfortunately, there are no provisions to sell shredded currency to individuals through the mail.

Shredded currency is available only from certain Federal Reserve Banks. They sell it only under contract to buyers who will purchase all of the residue for at least a one year period. It is not readily available for distribution nor for sale in small quantities to individuals because of operational difficulties and excessive administrative work for Federal Reserve Banks.

The Treasury Department approves the use of shredded currency in certain circumstances. One permitted use is recycling it (mixing it with other materials) to form a useful manufactured product such as roofing shingles or insulation. In addition, the shredded currency may be placed in firmly sealed containers as novelty items like pens, ornaments and jewelry. However, the Treasury will allow companies or other parties to sell the shredded currency in its original form or where it is readily not recoverable.

Q. I have an old currency note. Can you tell me what it is worth? I would like to sell it.

A.The Treasury Department does not render opinions concerning the numismatic value of currency notes, and will redeem only those notes issued by the United States Government. Any such redemption would be only at the face value of the notes. If you wish to have the currency mentioned in your letter appraised, We can only suggest that you contact several currency collectors and dealers. Listings are available in the telephone directory under the headings of COINS and HOBBIES.

Currency dealers and collectors consider the condition, series date, denomination, production totals, and other factors when evaluating currency notes to figure out their numismatic value. Each note is different from every other. In addition, grading is not an exact science, varying from dealer to dealer. Therefore, it is possible to have the same note appraised at different values. There is sometimes a wide range (both above and below the market price) in the values that they quote when buying and selling currency notes. This also may be due to the dealer's current inventory and the availability of similar notes in the marketplace.

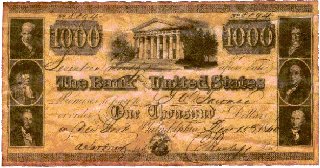

Q. I have a $1,000 currency note from the Bank of the United States. It is dated December 15, 1840 and has the serial number "8894." Can you tell me what it is worth now and where I can cash it in?

A. Currency notes from the Bank of the United States are something that we have seen many times. Our office receives many inquiries concerning the authenticity of these notes. It is important to note, first, that the Treasury Department did not issue notes intended for circulation as currency until 1862. This being the case, these notes are not obligations of the United States Government.

You may be interested in a brief history of the Bank of the United States. Our research has shown that the "first" Bank of the United States was founded in 1791 and existed until 1811; the "second" bank operated from 1816-1836. The United States Government held 20 percent of the Bank stock, named five of the 25 trustees, and granted the charter to the Bank.

In 1836, however, President Andrew Jackson vetoed a bill to renew the Bank's charter, withdrew United States Treasury funds from the Bank, and ceased all United States Government involvement in the Bank's operations. In 1837, the trustees of the Bank secured a charter from the State of Pennsylvania. Then, they paid the United States Government for its outstanding interest and swapped old stock for new stock on a one-to-one share basis. The Bank's name changed to the Bank of the United States of Pennsylvania.

After 1837, the history of the Bank was very rocky. On February 4, 1841, the Bank closed its doors. This action left many creditors, including the London Merchant Bank, Baring Brothers, and the Rothschild family, with over $25 million in claims. They were lucky to receive one-third value for their claims.

Because the Treasury Department did not issue these notes, we have no way of verifying their authenticity or figuring out their value. It is likely, though, that the is part of a series of antiqued reproductions issued in various denominations and forms for use in advertising campaigns. The most popular of these bear the serial number 8894. These notes are so widespread that they were the subject of an August 5, 1970, article in COIN WORLD.

Q. I have some old silver certificates. How can I trade them in for silver dollars?

A. On March 25, 1964, C. Douglas Dillon, the 57th Secretary of the Treasury announced that silver certificates would no longer be redeemable in silver dollars. This decision was pursuant to the Act of June 4, 1963 (31 U.S.C. 405a-1). The Act allowed the exchange of silver certificates for silver bullion until June 24, 1968. This was the deadline set by the Congress. Since that date, there has been no obligation to issue silver in any form in exchange for these certificates. You may be interested to know that the Congress took this action because there were approximately three million silver dollars remaining in the Treasury Department's vaults. These coins had high numismatic values, and there was no way to make an equitable distribution of them among the many people holding silver certificates.

Silver certificates are still legal tender and do still circulate at their face value. Depending upon the age and condition of the certificates, however, they may have a numismatic value to collectors and dealers.

Q. I have some old gold certificates and would like to trade them in for gold. What should I do?

A. Gold certificates were withdrawn from circulation along with all gold coins and gold bullion as required by the Gold Reserve Act of 1934. Gold certificates circulated until December 28, 1933. That is when the President ordered private owners of gold certificates to deliver their notes to the Treasurer of the United States by midnight on January 17, 1934. It was then illegal to hold gold certificates. C. Douglas Dillon, the 57th Secretary of the Treasury, removed the restrictions on the acquisition or holding of these notes on April 24, 1964.

Under 31 U.S.C. 5118(b) as amended, "The United States Government may not pay out any gold coin. A person lawfully holding United States coins and currency may present the coins for currency . . . for exchange (dollar for dollar) for other United States coins and currency (other than gold and silver coins) that . . ." citizens may lawfully own. Although gold certificates are no longer produced and are not redeemable in gold, they still maintain their legal tender status. You may redeem the notes you have through the Treasury Department or any financial institution. The redemption, however, will be at the face value on the note. These notes may, however, have a "premium" value to coin and currency collectors or dealers.

Article

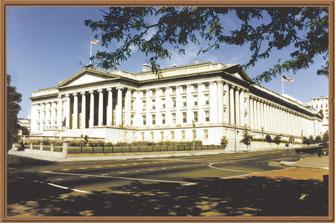

How to visit the U.S. Treasury

If

you plan on visiting the capital you can take a tour of the Treasury by gaining

an advance reservation through your local Congressional Representative.

If

you plan on visiting the capital you can take a tour of the Treasury by gaining

an advance reservation through your local Congressional Representative.

The address is: 15 St. and Hamilton Place, NW, Washington, DC

The tours are free, given on most Saturday mornings and last about an hour. They are available to citizens and legal residents. Your name, date of birth and SS number is required when making a reservation and photo ID is required when you arrive to take the tour.

For more information visit The Office of the Curator.

Or take a Virtual Tour now.

It is wise to use public transportation since parking is quite far. Hoofing it through the capital is not for the faint of heart. Many buildings and monuments seem closer than they are because of their massive size.

A bus tour of the Capital is wonderful way to see everything.

The

double-decker DC tours bus allows you to jump on and off all day

as it circles the city covering the major sites.

We also recommend visiting Mt. Vernon, the home of our first President George Washington. The self guided tour will provide a headset that will walk you through the entire plantation.